How Iran loses in joint oil and gas fields to neighbors?

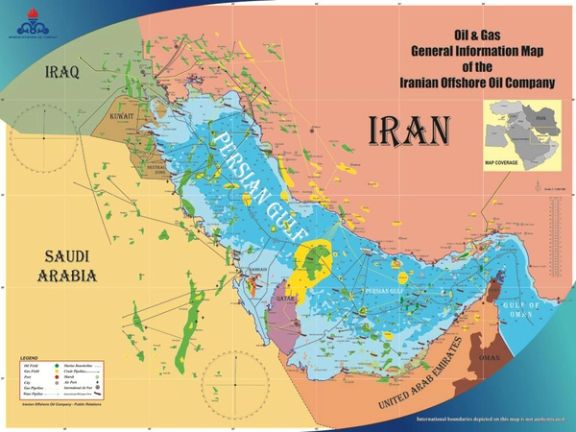

Iran faces significant challenges in its 28 joint oil and gas fields with neighboring countries, where it consistently falls behind in production compared to its neighbors.

Iran faces significant challenges in its 28 joint oil and gas fields with neighboring countries, where it consistently falls behind in production compared to its neighbors.

Experts, as cited by Tehran ILNA news agency recently, attribute Iran's primary challenge in these shared fields to a lack of investment.

The most substantial joint fields for Iran are with Iraq, Qatar, and Saudi Arabia—neighbors that have significantly increased their oil and gas production with the help of international, particularly Western, companies. These countries have ambitious plans for further increasing their reserves extraction.

In contrast, due to limited foreign investment and a weak private sector, Iran's Ministry of Oil relies only on a 14.5% share of oil revenues for investments (a little more than $5 billion last year). Statistics from the Parliament’s Research Center underscore a significant decline in annual investment in the country's upstream oil and gas projects, dropping from around $18 billion in the 1990s to about $7 billion in the early 2010s, and further decreasing to $3 billion since 2017.

Not only international and US sanctions have reduced Iran’s oil export revenues in the past decade, but the adverse environment created by these sanctions have made foreign investment or borrowing impossible for Tehran.

The joint fields represent 20% of Iran’s extractable oil and 30% of its gas reserves. Despite holding the world's second-largest gas reserves and the fourth-largest oil reserves, with 33 trillion cubic meters and 157 billion barrels respectively, Iran faces challenges in fully exploiting these resources in collaboration with its neighbors.

Iran and Saudi Arabia

Iran shares several oil and gas fields with Saudi Arabia, producing only about 35,000 barrels per day from the Forouzan field (known as Marjan in Saudi Arabia). In contrast, Saudi Arabia produces 14 times more oil from this field and aims to increase daily production by 60% to 800,000 barrels and gas production by 70 million cubic meters under a $12 billion contract with international companies over the past five years.

Iran shares another large gas field, Farzad (called Hasbah in Saudi Arabia), where negotiations with Indian companies that discovered the field have not yielded results over two decades ago. Iran itself lacks the $5 billion investment capacity required for developing this field, while Saudi Arabia developed and commenced gas production from this joint field since 2013, currently producing over 30 million cubic meters of gas daily with Aramco's ongoing plan to swiftly increase daily production to 75 million cubic meters.

Saudi Arabia and Kuwait also share two oil and gas fields, Esfandiar (Lulu) and Arash (Al-Durra), with Iran, where they have developed the Esfandiar field for years and plan to develop the latter soon. However, these two countries reject Iran's share in the Arash field, claiming exclusive rights to gas extraction, a stance Iran does not accept. Iran has not even initiated development in these fields.

Joint Fields with Iraq

Iran's largest joint oil fields are with Iraq, where Iraq extracts four times more oil than Iran from these fields. Iraq has entered significant contracts with Chinese, Russian, and Western companies to boost extraction efforts.

In 2013, Iran produced 90,000 barrels of oil per day from these fields and aimed to increase production to 1.2 million barrels per day by 2021 with Chinese assistance, focusing on fields like Yadavaran, Azadegan, Azar, Changouleh, Aban, and Paydar. However, Chinese companies fulfilled only a fraction of their commitments, leading Iran to achieve a "nominal capacity" of oil production, reaching 350,000 barrels per day from the joint West Karoun fields with Iraq.

In contrast, Iraq's oil production has surged by 1.4 million barrels per day since 2013, primarily driven by developments in joint oil fields with Iran. Iran estimates needing $11 billion in investment to develop five major joint oil fields with Iraq, an amount equivalent to just two months of the country's pre-sanctions oil revenue. However, the complex structure and predominantly heavy oil type of these fields mean that Iran's current technology can only extract 5 to 10% of the 64 billion barrels of in-situ reserves. Consequently, the involvement of advanced Western companies in developing these fields appears inevitable.

Southern neighbors

Iran shares two oil fields with the UAE, Salman and Nusrat. Both countries extract 50,000 barrels of oil per day from the Salman field. However, Iran faces challenges due to the lack of gas gathering facilities, resulting in the flaring of 11 million cubic meters of associated gas daily. In contrast, the UAE efficiently produces gas from the layers in this field. Additionally, the UAE produces 65,000 barrels per day of oil from the Nusrat field, which is 20 times more than Iran's production from the same field.

Iran also shares the Hengam oil field with Oman, with both countries producing 10,000 barrels per day.

Iran's largest gas field is South Pars (North Dome), shared with Qatar. Qatar started gas extraction a decade earlier than Iran and has produced twice as much gas. While the Iranian side of the South Pars gas field has entered its second half-life in 2023 and experiences annual production declines of 10 billion cubic meters, Qatar has recently signed $29 billion worth of contracts with international companies to increase production by 40% by 2027 and 60% by 2030. Currently, both Iran and Qatar produce 180 billion cubic meters annually from South Pars.

Iran's options for increasing production lie in installing 20,000-ton platforms equipped with large compressors—a technology dominated by Western companies. All 24 phases of the Iranian side of the South Pars field are currently operational, leaving limited room for introducing new phases to enhance production or compensate for output declines from existing phases.

Qatar also extracts 450,000 barrels of crude oil from the oil layer of South Pars gas field, which is 13 times more than Iran's production from the same layer.

Additionally, Iran and Qatar share the Rashadat oil field, with each country producing between 10,000 to 15,000 barrels per day.

The only option for Iran is to reach an agreement with the West over its nuclear program, which is seen as leading to a weapons capability. It also needs to change its hegemonial policy in the region. Without a major shift in its foreign policy, energy and other sectors in its battered economy will struggle along.