What Lies Behind Iran’s Sharp Currency Drop?

Iran’s national currency, rial, has fallen sharply since early January, losing around 20% in less than three months, further raising the specter of higher inflation in the coming months.

The rial reached its lowest historical value during the past week, as each US dollar traded at 610,000 rials in open markets, 43% more than in March 2023.

The fall of the rial is hard to explain at the first glance as the country’s oil export volume has increased significantly. But a closer look at official statistics reveals lower growth in revenues. This can explain why the government has limited means to influence the currency market in Tehran.

According to Kpler’s statistics, Iran exported about 1.3 million barrels (mb/d) of crude oil and gas condensate in 2023, indicating a 48% growth year-on-year.

The country also exported 1.39 mb/d and 1.44 mb/d in January and February 2024, Kpler estimates.

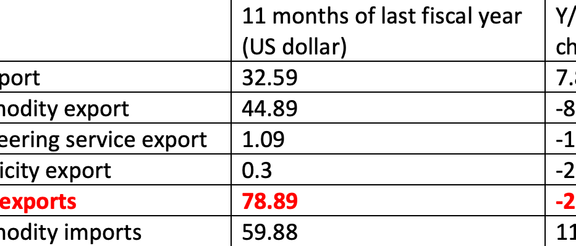

However, the latest Iranian Customs statistics show the country’s oil export revenues increased by only 7.8% year-on-year to $32.59, during 11 months of last fiscal year, from March 21, 2023, to February 20, 2024.

The reason for the huge gap between volume and value of Iran’s oil exports remains unclear, while oil prices in international markets declined only 17% year-on-year in 2023 and remained unchanged in 1Q2024, compared to the same period of last year.

It seems the country has given further oil discounts to Chinese refineries.

When the United States withdrew from the JCPOA nuclear deal in 2018 and imposed oil export sanctions on Iran, shipments of crude dwindled to around 300,000 barrels per day, one-seventh of pre-sanction volumes. But China began increasing purchases of Iranian oil when President Joe Biden was elected and signaled his plans to revive the nuclear agreement. As the administration engaged in negotiations that ultimately proved futile, sanctions enforcement lost their momentum, allowing Iran to more than triple its oil exports.

However, customs statistics show decline in non-oil export revenues and a notable increase in imports, that has lately led to a trade imbalance.

Foreign trade balance

The Custom statistics show $19 billion surplus in foreign trade in 11 months of last fiscal year, but the figure does not include Iran’s total imports, including services such as transportation of its oil exports by foreign vessels, as well as natural gas, gasoline, diesel and electricity imports.

Traditionally, Iran’s service imports are about $15 billion annually, while its service export is a half of this figure. Also, in the last three months media in Tehran report a negative trade balance.

Ali Nazi, vice-president of The Islamic Republic of Iran Shipping Lines (IRISL) announced May 2023 that Chinese independent ports, that handle most of commodity loading and unloading operations, do not allow Iranian ships to dock due to sanctions anymore. As a result, most of Iran’s energy and other trade with China are handled by Chinese or other vessels.

Iranian ships are allowed to dock only in two state-run ports, where Ali Nazi descried them “inappropriate” for commodity trade due to poor facilities as well as the increase in loading and unloading time and cost.

IRISL has faced even tougher conditions in operating elsewhere, especially European ports.

On the other hand, Iran has to use foreign tankers and ship-to-ship operations for oil exports to bypass US sanctions.

Therefore, it seems the country’s services trade imbalance has increased significantly during 2023-2024.

Iran also started natural gas, gasoline and diesel imports during last fiscal year, while its electricity imports also increased due to domestic shortages.

The Custom statistics, don’t include these items as well.

On the other hand, Iran has a huge amount of capital flight.

The Central Bank of Iran (CBI) has not published the capital outflow statistics for the past fiscal year, but it was $15 billion in the previous year (March 2022-March 2023).

Hard currency problem

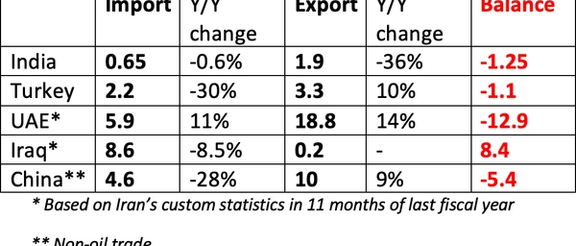

Iran has negative trade balance with all of its major partners, except Iraq and China. Therefore, it can’t use, for instance, Indian rupee, Turkish lira or UAE’s dinar for covering trade with these countries.

Iran can use Chinese yuan for covering negative balance in non-oil trade and pay for Chinese services, but it needs hard currencies like US dollar or euro to cover negative trade balance with other partners.

It is noticeable that according to Eurostat (European statistics body), 27 EU members exported 3.934 billion euros worth of goods to Iran, while imported only 799 million euros from the country in 2023.

Iraq was the only major open door for Iran to access US dollars, but Washington in 2023 imposed tough sanctions on several Iraqi banks that were involved in USD smuggling into Iran.

The US sanctions on Iraqi banks have put Iran in a very complicated situation, because it has about $9 billion surplus commodity trade with Iraq exporting gas and electricity, while the Iraqi dinar is a useless currency for covering Iran’s foreign trade negative balance.