OPEC Figures Contradict Iran's Oil Production Claims

Latest figures released by OPEC reveal a significant discrepancy between Iran's recent claims about its oil production and the actual data.

Latest figures released by OPEC reveal a significant discrepancy between Iran's recent claims about its oil production and the actual data.

The report was released on Thursday, a day after the National Iranian Oil Company (NIOC) Managing Director Mohsen Khojasteh-Mehr – a deputy oil minister -- claimed that the country's daily oil production would surge by 250,000 barrels to reach 3.5 million barrels by the end of summer, meaning that the current figure stands at 3.25 million barrels.

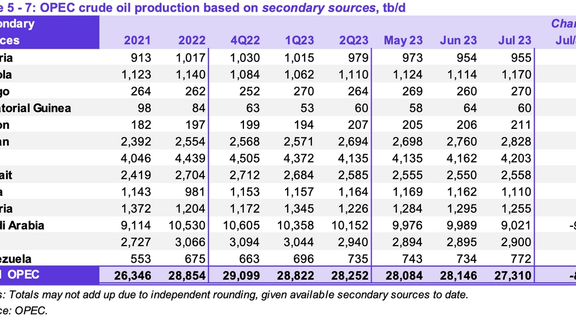

However, the latest OPEC statistics suggest that Iran's daily oil production amounts to only 2.828 million barrels, indicating a substantial gap of 422,000 barrels with the Islamic Republic’s figure.

Furthermore, OPEC's new figures highlight that Iran's oil production experienced an 11% growth in the first seven months of the current year, yet the country's oil price has plummeted by over 24%. Iran's daily oil production increased by 274,000 barrels until July, still falling short by a million barrels compared to the reported 3.8 million barrels it used to produce prior to sanctions imposed by the United States.

The backdrop of this production surge lies in the aftermath of the 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear deal, which saw the lifting of international sanctions on Iran and a subsequent increase in revenues. Iran's oil revenues temporarily soared to $66 billion in 2017. However, this upward trajectory was disrupted after the United States withdrew from the JCPOA in May 2018, which led to renewed sanctions that intensified a year later.

As a result, Iran's oil exports faced a significant decline, falling to between $15 - $20 billion by 2020. The tide began to turn towards the close of that year after the election of US President Joe Biden, who expressed his intention to reinstate the JCPOA. China, in response, embarked on a trajectory of more oil imports from Iran.

Presently, China remains the main customers of the Iranian oil. Meanwhile, data from Kepler, a data analytics company that also tracks oil tankers, indicates that Iran's average daily oil and gas condensate exports to China during the first seven months of 2023 have been hovering around one million barrels per day, up from roughly 325,000 bpd in 2020 and just 160,000 bpd in August 2019, in the wake of tightened US sanctions.

While oil has been trading at around 75-82 dollars in the past several months, Iran International reported in December that Tehran provides huge discounts to China, charging as little as $37 per barrel. A report by The Wall Street Journal in July said Iran is exporting the highest amount of crude oil in five years, but it offers discounts of up to $30 per barrel.

No matter how many buyers or how much trade Iran manages to secure for its exports, it faces serious obstacles in bringing in the revenues and money transfers due to US banking sanctions, Mohammad-Hossein Malaek, who served as Tehran’s envoy for four years under former president Mohammad Khatami, told the Iranian Labour News Agency earlier in August.

The former envoy highlighted China’s purchase of Iranian oil never stopped no matter the status of US and international sanctions on the Islamic Republic, but the country faces serious obstacles to pay Iran for its crude, pushing Beijing to barter goods and services to with ally.