Iraqi Officials Wary Of Dollar Smuggling To Iran

Amid increasing US restrictions on Iraqi banks to curb dollar smuggling to Iran, some politicians have revealed details about how the Tehran smuggles dollars.

Amid increasing US restrictions on Iraqi banks to curb dollar smuggling to Iran, some politicians have revealed details about how the Tehran smuggles dollars.

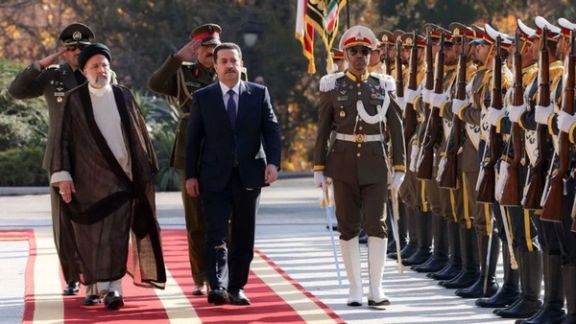

Muhammad Nuri Aziz, a member of the Iraqi parliament, said on a television show Monday that Iraqi Prime Minister Mohammed Shia al-Sudani and the country’s central bank are aware of the schemes Iran uses to get hold of US dollars it desperately needs amid US sanctions. The lawmaker noted that the smuggling started during Mustafa Al-Kadhimi's term as prime minister and still continues.

Soran Omar, another member of Iraq’s parliament, told Iran International in an interview on Tuesday that at least 5,000 shell companies have been registered to facilitate the dollar smuggling network.

“It is true that in the cabinet of Mohammad Shia al-Sudani, there have been more efforts and preventive measures to curb dollar smuggling to Iran, showing better performance compared to previous governments. However, this does not mean a real halt," he said. “On the contrary, when one measure is adopted, another loophole for dollar smuggling is opened.”

Omar added that “unfortunately, most private banks in Iraq, which are backed by corrupt officials, are the main cause of dollar smuggling.” “It is quite clear that each of these banks are affiliated with which individuals,” he highlighted, suggesting that there is no resolve in the government to stop the smuggling.

He warned that considering the new US measures against Iraqi banks to stop the flow of money to Iran, new channels may open to keep the smuggling ongoing.

A source with the Iraqi government told Iran International that following the recent restrictions by the US, a portion of the smuggling is being carried out through shell companies, electronic travel cards, online shops, exchange offices, and even suitcases.

According to the source, some people have created hundreds of electronic cards with different names and used them to buy $20,000 to $30,000 from Iraqi banks. Then, they cash the money in another country and transfer it to Iran.

"Some people have managed to smuggle more than one million dollars singlehandedly," the informed source said.

Reports about the transfer of $165 million to Iran within less than a month by just one exchange office led authorities to discover dozens of similar cases by other exchange offices.

Jamal Coujar, another Iraqi lawmaker, told Iran International that if the administration of Shia al-Sudani and the Central Bank do not take serious measures to prevent money laundering, fresh rounds of US sanctions will hit Iraqi banks.

The credibility of the Iraqi banking system has been tarnished due to the Islamic Republic's influence, and US sanctions have tightened their grip on Baghdad because evidently all Iraqi banks have had interactions with the Islamic Republic.

The only commercial gateway for exports and imports with Iran is Iraq, whose financial dealings with the regime are not properly supervised, Coujar said, adding that “billions of dollars have been transferred to Iran,” but authorities have remained silent. “It has become evident that all Iraqi banks have had interactions with Iran, and this situation has only benefited Iran and harmed Iraq,” he noted.

Last week, 14 Iraqi private banks sanctioned by Washington over helping to siphon US dollars to Iran said they were ready to challenge the measures and face audits and called on Iraqi authorities to provide assistance.

The US barred the Iraqi banks from conducting dollar transactions as part of a wider crackdown on dollar smuggling to Iran. The latest sanctions, along with earlier ones, have left nearly a third of Iraq's 72 banks blacklisted, two Iraqi central bank officials said.

The dinar tailspin against the dollar has worsened since the New York Federal Reserve imposed tighter controls on international dollar transactions by commercial Iraqi banks in November to halt the illegal siphoning of dollars to Iran.

Under curbs that took effect in January, Iraqi banks were required to use an online platform to reveal their transaction details. But most private banks have not registered on the platform and resorted to informal black markets in Baghdad to buy dollars.

Iran International revealed in May that an aide to former IRGC’s Quds force commander Qassem Soleimani, is a key figure in money laundering for Tehran. Iran International also reported some details about the inner workings of a Quds force unit tasked with smuggling money from Iraq to Iran, proving that the Islamic Republic’s embassy in Iraq is also involved in money laundering operations aimed at funneling revenues from oil and gas exports back to Iran.