How A Revised Nuclear Deal Would Affect Iran’s Non-Oil Exports

Tehran has announced that in the first month of the Persian year 1401 (April 2022), Iran’s non-oil exports grew 25 percent compared to the same month last year.

Tehran has announced that in the first month of the Persian year 1401 (April 2022), Iran’s non-oil exports grew 25 percent compared to the same month last year.

This growth follows a 40 percent increase in the country’s non-oil exports over the entire previous year, which reached $48 billion — a gain made possible by loose sanctions enforcement and global inflation in 2021.

When the Trump administration withdrew in May 2018 from the Iran nuclear agreement, formally known as the Joint Comprehensive Plan of Action (JCPOA), the reimposition of U.S. sanctions cut Iran’s GDP growth, put downward pressure on Iran’s oil exports, caused massive inflation, led to an exodus of foreign companies from Iran, and limited Iran’s access to both its foreign reserves and its oil and non-oil export revenue.

Under pressure from sanctions, Iran’s oil exports declined significantly. Tehran exported 2.6 million barrels per day in June 2018, the month after Washington withdrew from the JCPOA, but its exports fell to 800,000 barrels per day in December 2018 and further slid to 385,000 barrels per day in May 2019.

From there, Iran’s oil exports climbed upward, but have yet to return to their June 2018 high. Iran exported 555,000 barrels per day in December 2019, 1.1 million barrels per day in December 2020, 1.4 million barrels per day in December 2021, and 1.1 million barrels per day in April 2022, according to the UANI’s tanker tracker.

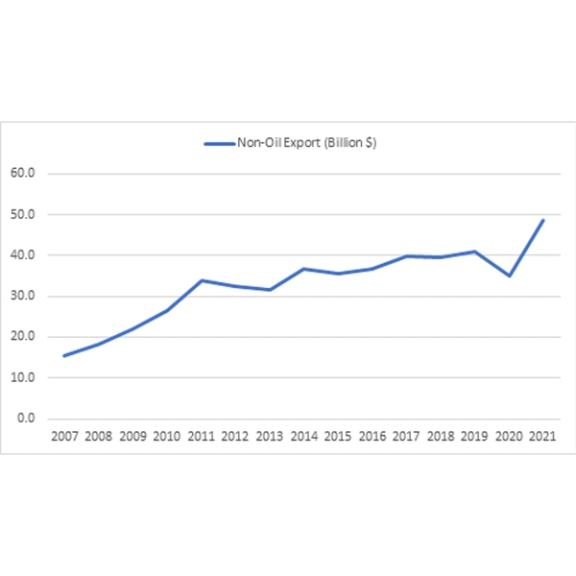

The sanctions against non-oil exports, however, failed to exert a comparable downward pressure. In 2017, Tehran exported $39.9 billion of non-oil goods. The following year, its exports slightly dropped to $39.6 billion, but in 2019 they jumped to $41 billion. Only in 2020, mainly driven by the pandemic-caused global recession, did Iran’s non-oil exports drop to $35 billion. A year later, though, Iran’s non-oil exports reached their peak of $48 billion.

Still, the removal of non-oil sanctions may lead to a further 15 to 25 percent increase in non-oil export revenue and will make that revenue more accessible than it now is. Given the lack of detailed data for Iran’s non-oil exports over the last few years, I reach this number by considering the change in prices during the forecast period against the price levels during the Persian year 1400. I use an average of oil price and the S&P GSCI Non-Energy Commodities index to create Iran’s exports basket. This assumption is based on the 50 percent share of oil-based products in Iran’s non-oil exports. As an alternative I create Iran’s export basket using the oil price and Global Price of Non-Fuel index. I then use the change in Iran’s exports from 2015 to 2016 (the year after the nuclear deal), with price changes taken into account, and use it to estimate how return to the revised JCPOA will affect Iran’s non-oil exports.

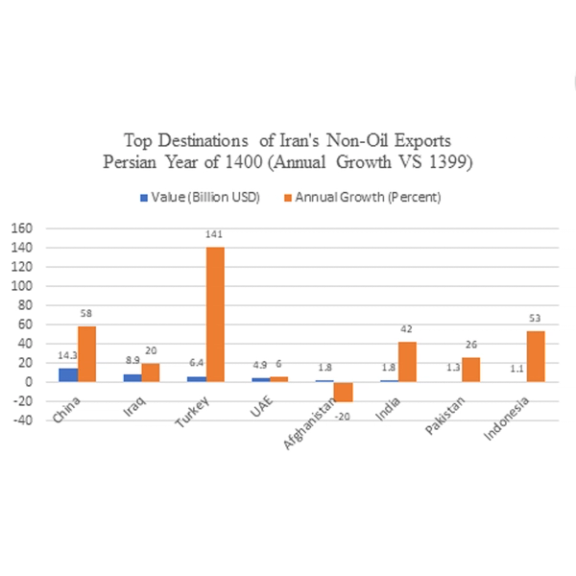

According to a report by the state-run Trade Promotion Center of Iran, key items in Iran’s non-oil exports were natural gas at $4.9 billion and 84 percent growth, polyethylene at $3.1 billion, methanol at $2.2 billion and 87 percent growth, and liquid propane at $1.9 billion and 96 percent growth. Four countries served as the destinations for 70 percent of Iran’s total non-oil export: Tehran exported $14.3 billion to China, $8.9 billion to Iraq, $6.1 billion to Turkey, and $4.9 billion to the United Arab Emirates.

Source: Central Bank of Iran

The Central Bank of Iran’s data show a trend of consistent growth in Iran’s non-oil exports over the last 15 years. Two waves of sanctions — 2010-2013 and 2018-2020 — disrupted this upward trend but have failed to stop or reverse it. The massive jump in the Persian year 1400 (April 2021-March 2022) to $48 billion was driven largely by higher prices. This conclusion is based on a review of the weight of some key items in Iran’s exports such as methanol. However, due to lack of detailed data for all items, the conclusion is not definitive.

Source: Trade Promotion Center of Iran

The lax enforcement of non-oil sanctions has also played a role. Non-oil products are heterogenous and much easier to repackage, hide, and re-export, so enforcement is more difficult. Furthermore, many of Iran’s neighbors are keen to ignore Tehran’s sanctions busting activities, hoping to take advantage of related business opportunities. Even so, Washington could have enforced non-oil sanctions more effectively if it had decided to allocate more resources and political capital to its efforts.

If the United States lifts sanctions pursuant to a revised nuclear deal, Tehran’s non-oil exports could reach $55 billion to $60 billion in the first year of the deal. By increasing Iran’s oil and non-oil exports, lowering the cost of imports, and granting Iran newfound access to its foreign currency reserve, a revived JCPOA may provide Tehran with a financial package worth up to $275 billion in a 12-month period.